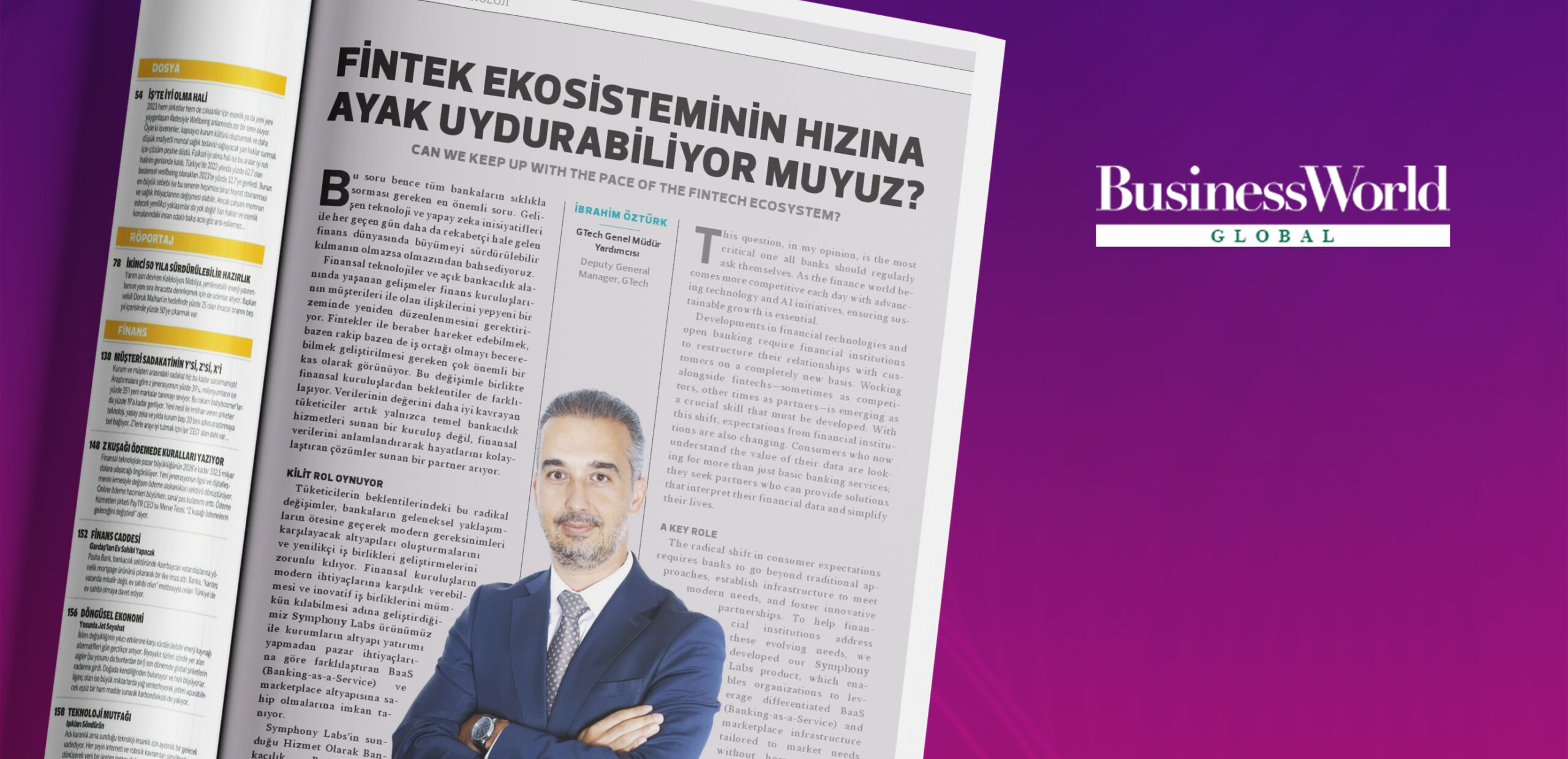

Can We Keep Up With The Pace of The Fintech Ecosystem?

Can We Keep Up With The Pace of The Fintech Ecosystem?

This question, in my opinion, is the most critical one all banks should regularly ask themselves. As the finance world becomes more competitive each day with advancing technology and Al initiatives, ensuring sustainable growth is essential.

Developments in financial technologies and open banking require financial institutions to restructure their relationships with customers on a completely new basis. Working alongside fintechs—sometimes as competitors, other times as partners—is emerging as a crucial skill that must be developed. With this shift, expectations from financial institutions are also changing. Consumers who now understand the value of their data are looking for more than just basic banking services; they seek partners who can provide solutions that interpret their financial data and simplify their lives.

A Key Role

The radical shift in consumer expectations requires banks to go beyond traditional approaches, establish infrastructure to meet modern needs, and foster innovative partnerships. To help financial institutions address these evolving needs, we developed our Symphony Labs product, which enables organizations to leverage differentiated BaaS (Banking-as-a-Service) and marketplace infrastructure tailored to market needs without heavy infrastructure investments.

Symphony Labs offers solutions such as Banking-as-a-Service (BaaS), Platform-as-a-Service (PaaS), and Security-as-a-Service (SECaaS), playing a pivotal role in helping banks achieve the transformation they need.

Through Banking-as-a-Service (BaaS), banks can entrust Symphony Labs with core banking infrastructure, allowing them to provide financial products and services more rapidly and flexibly through digital channels. This approach not only eases fintech partnerships but also enhances customer experience, transforming banks from mere financial institutions into financial technology platforms.

With Platform-as-a-Service (PaaS), banks are freed from infrastructure management and maintenance burdens, enabling them to focus resources on innovation and customer centric solutions, while benefiting from scalability and cost optimization. This allows banks to focus on their core mission—delivering top-notch services to their customers—rather than managing technology infrastructure.

Security-as-a-Service (SECaaS) provides banks with the latest security technologies and expertise, allowing them to protect customer data and operations from cyber threats and ensure compliance with regulatory requirements. By integrating these three services, Symphony Labs accelerates banks’ digital transformation journey, giving them a competitive advantage and positioning them as leaders in the future of finance.

- This interview was originally published in the September – November 2024 issue of Business World Global.